Basic Fund Policies

When managing its funds, UMI will undertake investment activities in keeping with its founding principles,

and in accordance with the following six basic policies.

01

- For industry ten years

in the future

- Target universal characteristics and core themes where regular business companies would hesitate to invest resources, and where the greatest impact can be expected, without being limited by short-term trends or linear models (e.g., technologies that are merely extensions or improvements in existing technologies). Focus on fields that could be adopted as new business in the material and chemical industries ten years in the future.

02

- Fund management by

industry professionals

- In past venture activities, there has been an overwhelming shortage of professionals in the material and chemical industries. UMI’s funds are operated by professionals in the material and chemical industries, without being limited by conventional approaches to venture capital, to enable the handling of venture business from a purely business perspective.

03

- Reliable hands-on

support and exit

strategies

- In business operations, hands-on support is essential, particularly in material and chemical industries that demand considerable time and effort. Many venture companies are forced into unreasonable IPOs, resulting in excessive and unnecessary business expenses. In its constant pursuit for the ideal form of the material and chemical industries, UMI offers dependable support in business operations, based on reliable exit strategies.

04

- Active collaborations

with large corporations

- In the material and chemical industries, where investments are growing rapidly, it is impossible for small venture companies to undertake all processes unassisted, from R&D to volume production and marketing. UMI has adopted a model that promotes effective collaborations between venture companies and large corporations, effectively utilizing available resources at those corporations to supplement the resources at venture companies.

05

- Extensive collaborations

that transcend the

boundaries of industry

- The material and chemical industries, which are positioned as upstream industries, cannot create new business if they restrict themselves to the upstream side. They must actively reach out to downstream industries, and promote new business based on the needs of those industries. By leveraging its extensive network of companies, UMI promotes a broad range of collaborations that transcend the boundaries of industries.

06

- Equal partnerships

- Open innovations cannot bring about positive results if either the venture company or the large corporation is given preferential treatment. Based on its vision of “Strengthening Japan’s technological capabilities by fostering outstanding material and chemical companies, and cultivating an industry structure that can compete in the global arena,” UMI offers support in collaborations and studies of investments, positioning every party involved as an equal partner.

Approach

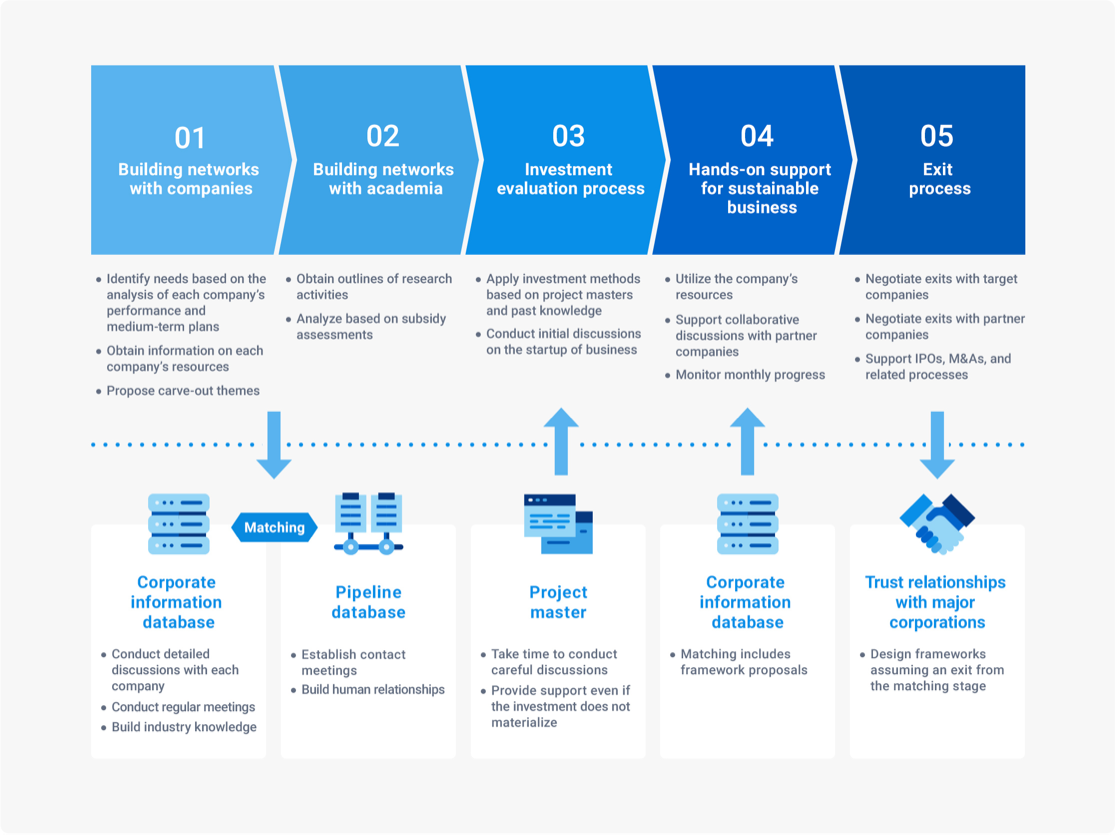

Investment activities are not limited to evaluation process of investments. It requires much broader activities starting from building networks with corporations and academia which will lead into careful set up and validation of investment structure during investment evaluation process. After investment, we work closely with the venture companies to successfully exit based on this investment structure hypothesis.

Investment themes

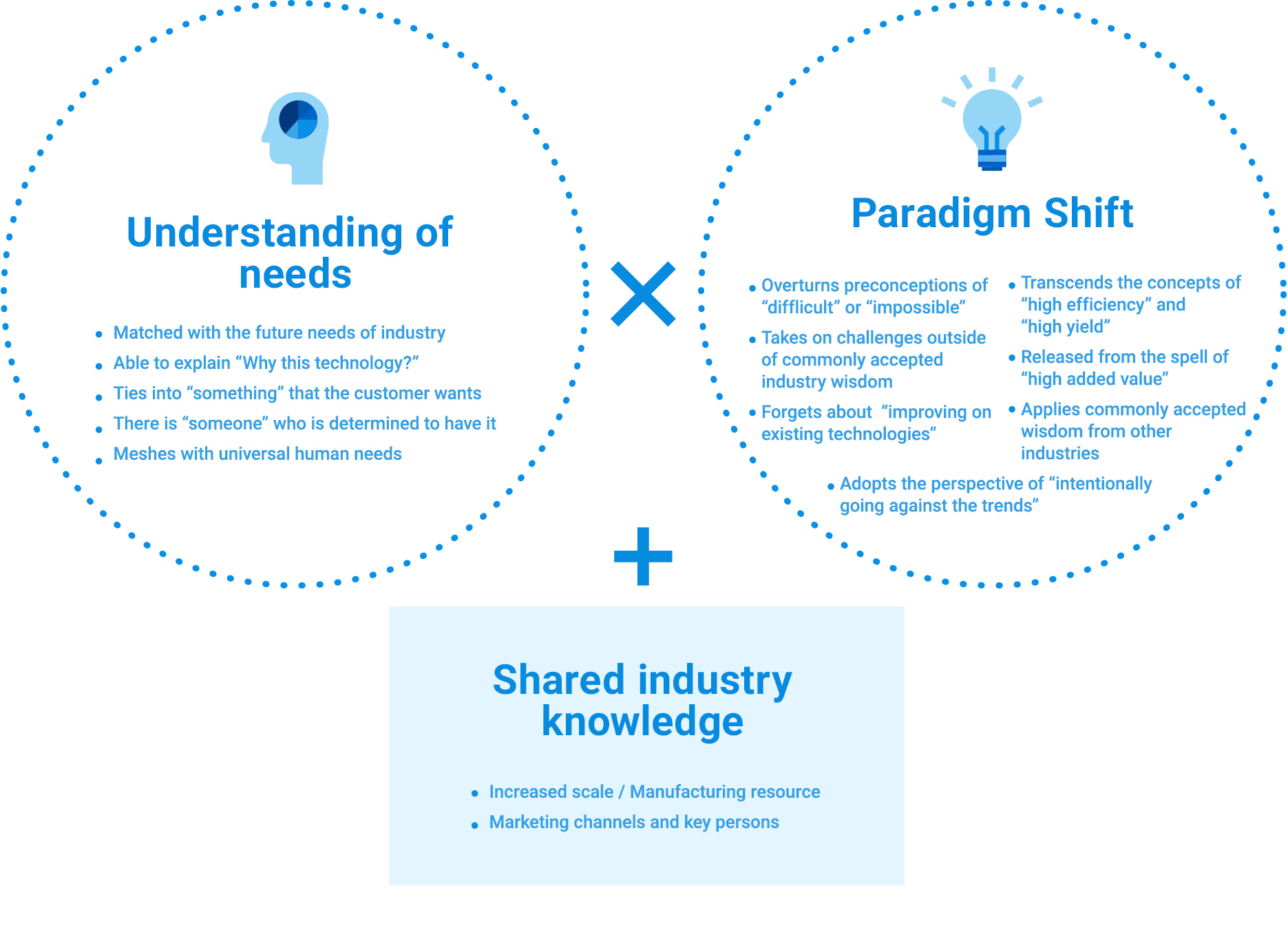

Up to now, it has generally been considered difficult, or even impossible, to verify business potential in the material and chemical industries, and even more so for venture companies. Nevertheless, activities aimed at verifying business potential have the power to overturn conventional wisdom, by incorporating unprecedented ideas (and in some cases ideas that would otherwise be rejected as “unattainable”) which focus on meeting deeply seated needs. Based on this knowledge, UMI targets investment themes that represent an Understanding of Needs combined with a Paradigm Shift, and leverages material and chemical technologies to tie these innovative themes into shared knowledge in the industrial world, promoting investments that lead to the creation of new business with an unparalleled probability of success.

Investment stage

We leverage our expertise in new business creation in the material and chemical industries to verify the reliability of venture investments in these fields, based on four assumptions: (1) Identification of business stages, and investments concentrated in stages 2 and 3; (2) Provision of appropriate equity investment; (3) Active collaborations with large corporations; and (4) Comprehensive hands-on management support.

Business stages in the material and chemical industries